I’ve always had an on and off relationship with money. I’ve gone through phases of embracing money as a vehicle for financial wealth, and I’ve also had moments where I’ve questioned the concept of monetary exchange and the trance-like control it has over all of us.

But whether we like it or not, money is important. Yes, even for a counter-culture minimalist like me who’s tried to rebel against giving the monetary system power.

So if money is so essential, debt is bad. Like, really bad!

And I don’t say this to make you feel terrible about your situation. No, I’ve experienced the extreme clutter of debt my whole adult life.

Despite having switched-on parents. Despite having legit qualifications and years of work experience in accounting and finance. I still managed to trap myself in debt from the moment I could get my hands on loans and credit cards.

From ages 19 to 30 I got into debt, got out of debt (thanks to my late fathers’ inheritance), then got into debt again, before putting on my grown-up pants, devising a plan and executing on clearing over $20,000 in debt in a six-month timeframe.

Man, I get a little emotional just reflecting on this rollercoaster journey with debt. But I’m glad I went through this experience. I’ve come out of it knowing with every inch of my body that debt free living is the way to go.

So in this mega-post (over 4,500 words), I’m going to share what I’ve learned to go from a damaged relationship with money to using minimalism to embrace debt free living. We also recorded a podcast episode breaking down how we used minimalism to pay off our debt.

Alrighty, let’s get into it.

Step 1 – Use minimalism to change the way you think about debt

We define minimalism as the process of identifying what is essential in your life and having the courage to eliminate the rest.

Minimalism is about ruthless intentionality.

In the minimalism world, we consider non-essential things clutter. This could include physical possessions, relationships, commitments to your calendar, messages in your inbox, or anything excessive or unnecessary.

But perhaps the worst kind of clutter is debt. I repeat, the worst kind of clutter is debt.

Think about it. When you have physical clutter in your home, it’s suffocating. You waste time trying to find things when you need them. You run out of space, and your dining table becomes storage instead of a dining table, your garage becomes storage instead of a garage, and so forth.

But then you have debt—which occasionally contributed to the purchases of things that are creating more physical clutter, e.g. excessively large houses, additional vehicles, clothing, decor etc.

And on top of that, you lose money (which is actually hours worked) to creditors because of brutal interest rates.

Debt is cluttered on multiple levels and a lose-lose situation for anyone (besides the banks).

That’s why you must deal with your debt with urgency.

Step 2 – Identify the root cause of your debt

To embrace a debt-free lifestyle, you need to understand your old habits and decision making.

This is a confronting exercise that forces you to look at your demons in the face. But you need to do it.

Here’s a timeline of the purchases that led to my debt:

- Bought a brand new motorcycle

- Sold motorcycles to buy a more expensive brand new motorcycle

- Sold motorcycle to buy a cheap second-hand car (finally started to mature)

- Bought TV, full-frame bed and mattress for 24 months interest-free

- Purchased furniture for a new apartment (which rent was also excessively high)

- Avoided calls from creditors because I was struggling to meet payments

- Received inheritance and cleared the debt

- Had to get a credit card for an overseas trip to rent a car, and also used it for our wedding expenses

- Started a business and got a business credit card to buy inventory for our online store

- Purchased tickets for flights for an overseas trip

- Used credit cards for everyday travel expenses

- Got into a bad contract with a marketing and advertising company for the online store

- Lots of little miscellaneous items purchased on credit

Now, depending on where you’re at in your life, my debt decisions are either horrifying or laughable. I know for sure that regardless of what you buy on credit, they are incredibly personal decisions based on your circumstances.

My debt decisions not only created a burden for me, but also for my wife Maša who effectively inherited my debt, and then proceeded to help me grow it.

As I reflect on all of these purchases, honestly, I don’t have any regrets. This borrowed money created some incredible experiences for me in my 20s and having that kind of debt early in my life has built my character.

Now it’s over to you. Write down all of your debt decisions. Add the month and year next to each item and reflect on why you made each purchase.

After that, take a moment to celebrate what you received as a result of those purchases.

Now say goodbye to creating experiences using debt in the future.

Step 3 – Set a life-changing goal

As inspiring as I try to be sometimes, I know that continuously repeating that debt is the worst kind of clutter, doesn’t mean you’re going to execute on a plan to get to debt-free suddenly.

You need something more driving you to debt-free living.

I know this to be true in our situation. It wasn’t until Maša and I decided that we were going to move from Australia to Slovenia, that we started to urgently analyse our debt situation.

Sure, we could move to Slovenia with debt, but we also intended to be self-employed when we moved. We calculated that our living costs would be significantly less if we removed our monthly debt repayments including the additional interest.

I’m not saying that you too need to set a goal of moving to Slovenia, although that would be pretty cool! But it does help to have something tangible to work towards.

When we were crushing our debt payments month-on-month, it didn’t feel like we were losing out on life. It was motivating because we knew we were one step closer to moving overseas.

So it’s time to step back and do some more thinking. What’s your big goal?

Is it to pay off your mortgage in the next five years? Is it to build a runway to start your dream business? Or do you want to downsize your job and go part-time so you can spend more time with your family?

Whatever your goal is, it needs to light you up inside. I remember when Maša got a photo of Ljubljana (the capital of Slovenia) framed and hung up on the wall above the head of our bed. So every time we walked into the room, we were reminded of our vision. Our debt needs to go to fulfil our vision.

Step 4 – Quickly build an emergency fund

Before you start making additional repayments to your debt, I suggest you put $1000 into a savings account as quickly as possible.

This is not unique advice. Having an emergency fund is a tried and true strategy in the personal finance community.

Seeing $1000 in my savings account helped me to build my financial confidence. It was a critical practical step to saying to myself, “I am in control of my money.”

It also gave me peace of mind that I had at least some money in case we were hit with any unexpected expenses. Because in the past, I didn’t have any savings and when that speeding fine came in, or ambulance bill arrived, I used my credit cards for payment, further worsening my debt situation.

So having an emergency fund is critical for your confidence and to avoid getting into more debt.

Step 5 – Set up a simple debt tracking spreadsheet

Okay, this is the beginning of the nerdy part of this article.

As methodical as I can be, Maša is the super practical one in our relationship. She would always ask me how much debt we had. And I was never able to give her a straight answer. She couldn’t understand why I didn’t know the numbers. It’s because I didn’t have a plan to address the problem, so what was the point in just validating the problem? Irrational, I know. But perhaps you’re in the same boat.

So pause for a second and see if you can answer this question: How much debt do you owe right now? (within a $100 give or take)

If you can answer the question, bonus points for you!

But if you’re like me, you don’t have a clue what your collective debt balance is. That’s because tracking your credit cards and loans individually gives you a false sense of clarity.

For proper perspective, you need to zoom out and see all of your debt on one page. This is an important step to address your emotional baggage with money.

Avoiding your overall debt balance is equivalent to avoiding the scales because you’re afraid to see how much you weigh. I also know this feeling well.

For this exercise, I recommend you use a spreadsheet in either Microsoft Excel, Apple Numbers, or what I use, Google Sheets. I suggest a spreadsheet because it automatically updates as you change specific figures, which is super convenient.

Step 5.1 – Get names, balances, interest rates, and minimum monthly repayments for all of your creditors

Alrighty, sh*t just got real. It’s time to do some digging.

Log into your online banking to get the exact balance (amount owing) for each creditor. This should be reasonably easy to locate in your transaction history.

You’ll also need to download last month’s statement for each creditor to get the interest rate and minimum repayment figure.

If you don’t have access to online banking, give your creditor a call to get this information.

Also, if you don’t have online banking, and you’re able to, please do set this up when you make the call. It makes managing your debt so much easier.

I mean, who likes calling the bank anyway? The phone assistant often tries to upsell products, you have to wait on hold, and you have to answer your dreaded security questions.

Once you set up your online banking, be sure to use a unique password and please please please remember this password. You’ll be logging into your account regularly moving forward, and you can’t afford to waste time resetting passwords.

Step 5.2 – Enter your balances into a spreadsheet

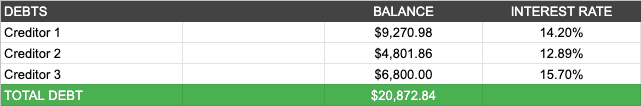

Setup a simple table like the one above to include the name of each creditor, the balances remaining, and the interest rate for each debt.

Total up your debt to get perspective of how much you owe. Then take a deep breath.

If you’ve made it this far, congratulations! Not many people dare to face their debt reality.

Step 5.3 – Organise your debt by priority

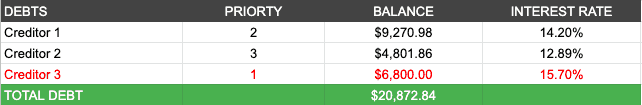

Now that you have your overall debt balance, it’s time to address the common question; what debt do you pay off first?

When I was drowning in debt, I had no plan of which debt to focus on. Whenever I got a bit of extra money, I would randomly select a creditor to make an additional payment. As you can imagine, this approach wasn’t very practical.

I suggest that you prioritise your creditors with the highest interest rate. So in the example above, creditor 3 is charging the most interest, thus why I’ve prioritised as the first goal.

Interest is an absolute killer, and it’s often the reason why many of us feel like we’re making no progress on our debt.

In my approach to clearing debt, I ruthlessly focus on one debt at a time. Sure, you need to meet the minimum payments for each creditor, but don’t make the mistake of trying to diversify your payments all at once. Pay off your first debt as quickly as possible and build momentum.

You need to feel progress! And talking about progress…

Step 5.4 – Build a payment schedule for each debt

It’s essential for you to feel progress on your quest for debt-free living. Your payment schedule is going to be your vehicle crushing your debt.

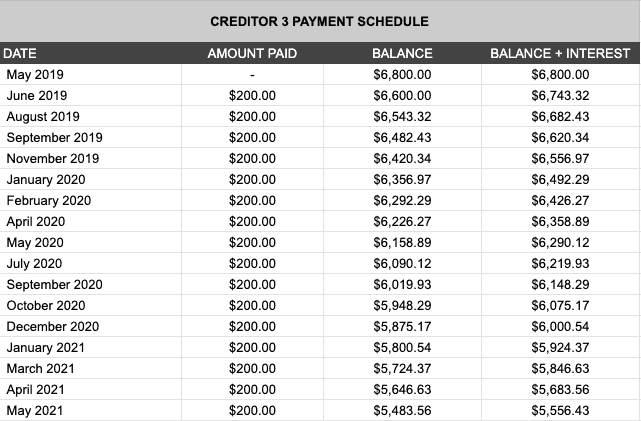

Above is an example of the schedule I used to track payments for each of my debts.

In the amount paid column, temporarily add your minimum payment amount indefinitely.

In the example above the interest rate is 15.7% and the minimum monthly payment is $200. It’s terrifying to see at the payment rate of $200, you would pay off a little more than $1,000 in two years. That’s the impact of interest on you. Yet you pay the bank three times more than that for the interest in that period.

Later on in this article, I’m going to show you how we tweaked our monthly income and expenses to create excess cash to pay down our debt quickly.

But first, we need to see if we can address this interesting situation.

Step 6 – Attempt to minimise your interest on each debt

Seeing all of your debt on one page is both empowering and deflating. Empowering because you have clarity on your situation but deflating because of the impact of interest charges.

Before we go onto the next step, I think it’s worth making some phone calls to see if you can reduce the interest rate on your balances.

The first option is to call your bank and ask for a hardship rate. I haven’t done this before, but I’ve read that some banks can be a little flexible for those struggling to make their payments. It’s certainly worth exploring as every little percentage counts!

The second option is one I’m more familiar with, and that’s to apply for a 0% interest balance transfer.

What this means is that you can apply for another credit card with an interest-free period. How much of your balance you can transfer to a 0% interest card is dependent on your credit rating.

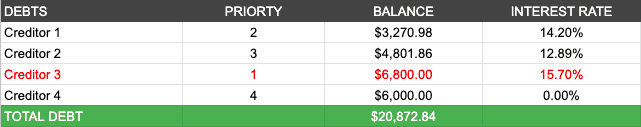

When I applied, I got approved for $6,000, which at first I was super disappointed with. But it did help. The interest-free period I secured was for 24 months.

So my new debt tracking spreadsheet looks like this:

Now I should make it clear that balance transfers are not some magic pill. Creditors are very strategic with these offerings to build up their customer base, preying on you to not have the discipline to pay off your debt within the interest-free period. There’s usually a transfer fee attached depending on the type of promotion, and if you don’t pay your account in time, you’re likely to get hit with astronomical interest rates. Please read the fine print carefully before applying for another credit card.

Balance transfers will not get you into debt-free living. Your behaviour will. But if you’ve established the right habits, then sure, this strategy works well to save on interest payments.

I should also say that if you’re already knee deep in debt, you might not get approved for a 0% interest credit card. So please manage your expectations when applying for a balance transfer. If it doesn’t work out, that’s fine. Below I’ve mapped out a robust strategy to crush your debt, balance transfer or not!

Step 7 – Calculate your minimum viable income (MVI)

Before you can determine your additional debt payments, you first need to review your living expenses.

I stole the concept of MVI from my friends at Fizzle who teach entrepreneurs how to make money doing something they love and applied it to personal finance.

What is the minimum viable income?

MVI is the lowest possible income you can live on. It’s about questioning how much you think you need to survive, versus how much you actually need to survive.

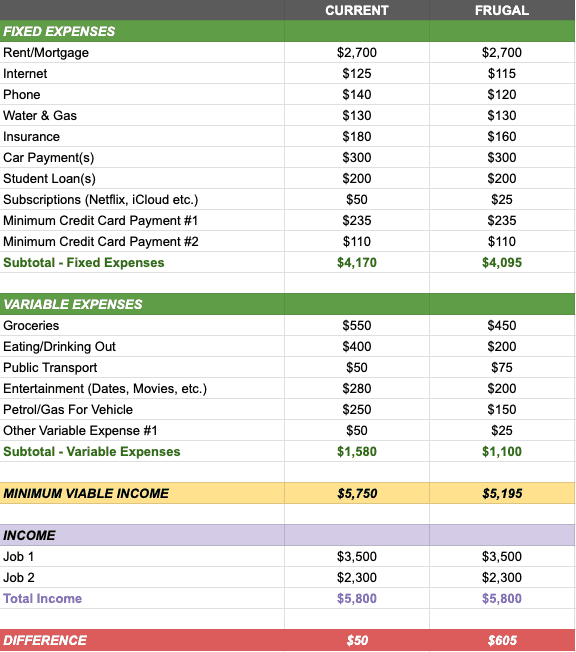

The MVI calculator is basically a budget spreadsheet with different options for different lifestyles. Below is an example of what an MVI calculator looks like.

As you can see in the above example, a lot of the potential to save money comes from rent/mortgage and variable costs.

A little later in this article, I’m going to talk about how you can leverage minimalism to challenge your idea of what frugal living means to you.

Also, you would’ve noticed three budgets. One based on your current expenses, another based on your projected frugal-level expenses and then finally, a budget based on your ramen-level expenses.

Ramen is, of course, a type of cheap noodle. The startup world often uses the term ramen when explaining a lean business. The idea is that at this level, you’re living on buying cheap ramen noodles every day to keep your costs down.

Step 8 – Create a dynamic monthly budget (that actually works)

While calculating your MVI is incredibly powerful, it’s still fundamentally a monthly budget.

The problem with fixed monthly budgets is that they’re not realistic. Traditional budgets are based on your average income and expenses. The challenge is that your income and expenses often change month to month.

So your projections are really just that…projections.

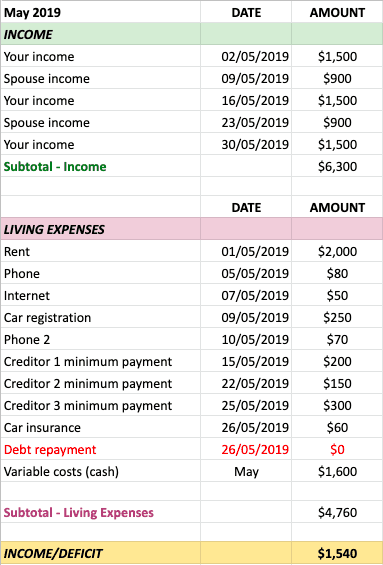

I wanted to find a way to forecast my actual income and expenses each month. So I created a dynamic monthly budget that only dealt with actuals. Here’s an example:

As you can see from the table, all of the income and expenses for the upcoming month are recorded. The result is either excess income or a deficit for the month (highlighted in yellow).

If you generate excess income after you make your minimum payments for debt, then you’re in a position to dump the extra cash towards your priority debt (in red).

We found this dynamic budget to be an absolute game-changer, as it took away ambiguity of how much we can allocate to debt repayments. We knew pretty much to the dollar what was coming up next month so we could confidently make decisions.

What about unexpected income or expenses? For any unexpected income, e.g. a bonus, gift or you sold something, we would add this income to our forecast and thus increase our debt repayment for the month. We’d use the same approach for unexpected expenses which decreased our debt repayment for the month.

In our experience, we never had to touch our emergency fund. But it still helped our confidence as we were aggressively paying down our debt.

The last point I want to make about the dynamic budget is the variable cost figure.

From our MVI calculator, we realised that food and discretionary spending was one of our greatest opportunities to save money. We put a cap on this spending by taking out cash for our variable costs for the month.

Having cash as opposed to card transactions held us accountable for our discretionary spending. Admittedly, we went over our cash budget approximately 50% of the time, but it was only marginal, so it made little impact on our goals.

Step 9 – Embrace minimalism to create some extra cash to pay off your debt

Alrighty, at this point you should be rolling. You have your spreadsheets in order, and now it’s time to use the concept of minimalism to continue to create pockets of cash.

Minimalist tip 1 – Always keep a list of things you need to buy

A common symptom of budget breakdown is impulse buying whether it’s food, clothes, technology etc.

In these situations, it’s usually sales that have incredible power and influence over us. Sales are designed to create urgency, so you take action.

The best way to overcome the power of sales is to keep a wishlist of things you need to buy.

When you have a list of future purchases, you can build it into your dynamic monthly budget. Also, when confronted with an urge for an impulse purchase, your wishlist will hold you accountable to stay on track.

Wishlist = essential. Impulse = non-essential.

Minimalist tip 2 – Consider downsizing your property or moving in with your parents

When reviewing your MVI, your rent/mortgage is usually your highest monthly expense. It’s also the most significant opportunity to increase your debt payments.

Now I know that this is a big decision, and indeed, one to not take lightly.

Maša and I loved the liberty of renting our apartment, and we never thought we’d be living with her parents, at any point! But when we looked at the numbers, it was more critical for us to pay our debt quickly than it was to continue paying rent and all of the costs that come with maintaining a property.

Years ago, I would’ve been embarrassed to tell people that I’m living with my in-laws. But with a strong foundation of minimalist thinking, I couldn’t care less of what society thinks of me. I did the work of creating a personalised goal and ruthlessly pursuing that goal.

For you, this might mean downsizing your property or moving slightly further away from the city area. Or maybe, just maybe, it means selling your property.

If success for you is no longer defined by having more, then everything should be on the table.

Run the potential scenarios in your MVI spreadsheet and see if relocating is a viable option for you.

Minimalist tip 3 – Sell your things

Another product of downsizing is the awareness it creates for all of the unnecessary things you possess.

But whether you downsize or not, it’s worth overcoming your resistance to declutter to minimise your possessions, and also earn some extra cash along the way.

Maša was instrumental in selling our things when we downsized. We ended up making an extra $2,000 in cash which we used to pay down on more debt.

Step 10 – Continue to refine steps 6 to 9 until you pay off your debt

Phew! You’ve almost made it to the end of the article, well done!

The next part is easy. Rinse and repeat all of the steps outlined in this post, but really focus on steps 6–9.

Here’s what I found changed with each step when I made progress with my payments:

Step 6 Repeated – Attempt to minimise your interest on each debt

When we paid off our first debt, and I made that fateful call to the bank to close my account (ah, such a good feeling!), in a desperate attempt to keep me on as a customer, they offered me a balance transfer up to $15,000!

Remember earlier how I said I was disappointed with the $6,000 credit amount I was approved for? Well, I didn’t factor in how my credit rating would improve as I paid off more debt.

So, I happily transferred the rest of my debt into a 0% interest account for 18 months. As I just paid off my first creditor, I was more confident than ever that I wouldn’t come close to exceeding the 18-month interest-free period.

Step 7 repeated – Calculate your minimum viable income (MVI)

Our MVI calculator became a go-to resource for us to plan the lives we wanted. As we continued to make progress on debt repayments, our clarity for money management improved, and we got even more specific with what expenses we tried to reduce, keep or eliminate.

We also built in a component for our business income and expenses to get a more accurate look at our financial situation. This evolved into a pretty robust spreadsheet that helped us to make more concrete decisions as to how we could monetise The Minimalist Vegan so we can eventually support our relatively low-cost lifestyle in Slovenia.

Step 8 Repeated – Create a dynamic monthly budget (that actually works)

The monthly budget continued to work like a charm month-on-month. The only thing that changed was the fixed cash amount we allocated to food. Each month gives us more data on a realistic cash amount for the next month.

Food is super essential to us, so we were happy to pay a little bit more for it.

At the same time, I’ve recently started eating one meal a day, which has decreased our monthly food expense, thus changing our monthly budget again.

Step 9 repeated – Embrace minimalism to create some extra cash to pay off your debt

You should always be pushing your minimalist boundaries. Continue to question what is essential and non-essential in your life. And through this process, you might find that you can get creative in finding ways to save money.

For us, the next step is to be completely car-less, which we’ve never done in our adult life. But running a car is expensive and bad for the environment, and I feel we’re ready for the challenge of treading more lightly. Especially if we live in a city where we’re not as dependent on a car. But even in suburban areas, we want to challenge ourselves.

All because of minimalism.

What’s your approach to debt-free living?

Thank you for taking the time to read about my minimalist approach to debt-free living.

I really do hope you’ve received a balance of inspirational and practical advice on how you can start a journey to living debt-free.

The steps I’ve outlined in this post are a culmination of the experiences I’ve gained trying to pay off my debt over 11 years, and what finally worked for me. I’m positive at least some of these steps will help you. With that, I want to end this post with three simple requests from you:

- I’d love to hear from you. The more perspectives, the better! What have you found to work to get to debt-free living? Or what challenges have you come across with debt management? Leave your experiences in the comments below.

- Can I also get your help to share this post with a friend who may need it? I’ve spent hours distilling what has taken me years to learn into one article, and I’d love for it to reach people that need some inspiration to get out of debt. Whether you copy and paste this link and text it to a friend or share it on social media, I’d appreciate any support. Thank you.

Thanks again for reading this post, and here’s to creating your minimalist debt-free lifestyle.

THANK YOU! This is such a well thought out piece. Thank you for sharing your knowledge and taking extensive time to craft this post. I will be using and sharing it!

Best wishes to you both!

Colleen

Having a plan and sticking to it are the best options to get out of debt, as you mentioned. Even when it might not be the social “norm” (living with the in laws) it is a solution that works.

Thanks for sharing, Mary 🙂

Hello Michael and Maša.

I totally agree with you, Michael, that debt is the worst form of clutter. That’s the reason why this year, as I started my first job, I immediatly begin to analyzed my spendings and savings.

I just wanted to share the excel template I use to manage it, which it’s inspired in Japanese culture. It’s called Kakeboo. I’m sure most of you know about it. There are ton of websites that share this template for excel or share links to the printed book version. I personally prefer working on excel as I can change the template according to my needs.

Hope you find value in this comment and thank you for sharing your experience through your debt free journey.

(Sorry for my english, not my first language).

Hi Marina, thank you for sharing the excel template. I haven’t heard of it before, but I’m looking forward to checking it out. Good on you for being so intentional about your money. Cheers, Michael.

Love this guys! My partner and I have the same mindset as you. We are trying to move towards debt-free living as well, so that one day we can just work part-time or volunteer more. Our debt is a little larger (quite a large mortgage!) but we are hoping to have it paid off in about 6 years. We’ve created a strict budget and try to live off just half of one of our incomes, and put the rest on our mortgage. We also find a “buffer” is so important! Good luck with everything.

Glad you enjoyed the post, Lucy! 6 years is not a long time away to pay off a mortgage! You’ve got this. Thanks for sharing your experience with us.

Thanks for the post Michael!

I have never really struggled with debt before, but I have experienced the lifestyle inflation that comes with graduating college and getting a moderately high paying job at a biotech company. After graduating my income practically doubled and so did my expenses. I even bought a new car because my old car was falling apart and I had a long, stable career ahead of me. I also helped to move my disabled father 2,500 miles across the country, and got married. Then, 2 years into my new job, I was suddenly laid off and my whole world turned upside down. There were no other biotech companies in the area and I had to move 2,500 miles across the country again to start a new job. This also meant moving my disabled father across the country again back to where he was, and near where my new job is. Being laid off completely changed my relationship with money and “stuff”. In the process my wife and I have discarded over half of our belongings and counting, paid off the car which we will keep until it falls apart, and decided to be more intentional with money. We have cut our expenses down to 1200 dollars per month, per person and can still make improvements. This has allowed us to not only save enough money for an emergency fund, but also begin investing in ESG funds and a few well-vetted individual companies trying to make the world a better place. Because we save over 50% of our combined income and are able to live comfortably with very little money, we will be able to retire from traditional office jobs in about 10-15 years (we are currently both 30) and be able to live as simply as possible. It didn’t seem like it at the time, but getting laid off was one of the best things to happen to me! It served as the wake up call most people don’t get until much later, if they even realize it.

As a side note, have you heard of ESG investing? It stands for Environmental Social and Governance investing. It means intentionally investing only in companies that seek to reduce their environmental impact, promote social welfare, and have high ethical standards. It has been found that businesses that adopt ESG standards tend to be more conscientious, less risky and consequently more likely to be successful in their long-term commercial aims (eg. oil and coal probably won’t be big energy producers in the future, but wind and solar will.) ESG investing would be a great topic to cover in the future and ties in well with minimalism and veganism.

Hi Dominic, it’s always a pleasure to hear from you on the blog.

What a story! I imagine being laid off was devastating at the time, but then look at what has happened since? Incredible. Cutting down your combined monthly expenses to $2,400 is very impressive, and that speaks to your intentionality with money.

I have heard of ESG investing and dabbled into some research when I was writing some content for Cruelty Free Super in Australia. Having said that I would love to “nerd out” on ethical investing and what that looks like moving forward. It’s a topic that’s not covered enough.

Thanks again for sharing your experience, I’m sure readers will feel inspired after seeing what you’ve done.

Our debt is quite big, because we bought an apartment. And it was so difficult decision! As a family with kids (and one parent working from home), we’re totally dependent on having one quite “adult” room. We’d been living in a studio flat with a toddler for several years, it almost drove us mad 🙂

I wanted to move outside of the city area, but my husband convinced me not to. And now I really appreciate that: short commute spares us at least 1.5 hours each day.

Uff… So for now our plan is quite simple: embrace minimalism, avoid unnecessary purchases, and build an emergency fund. We also hope to become car-free when the kids grow older. And downsize when they’ll leave the house.

Hi Evgeniia! Thank you so much for sharing your experience with us. It appears that you’re incredibly intentional about how you manage your money—and with such hyper-awareness, I know things will fall in place when they need to. All in time. Michael.

Hi Michael, I LOVED this post! In January this year I finally managed to become debt free, I had taken out a bank loan to buy a car (which I don’t regret at all) and the feeling of clearing that debt early and saving £££ in interest was amazing. I loosely used quite a lot of things you suggest in this post, I don’t have a computer so I just used the notes on my phone to write down my income, outgoings (on somewhere between a frugal and ramen budget) and then track my debt repayments. Like you, I created a timeline of all the repayments and the balance that would leave the debt at after the repayment. This also gave me a goal for when to be debt free by, I went over by a few months but I didn’t mind because had I not set that goal, I would still be in debt now and looking at years left on the loan. It was so empowering to become debt free, not only because I had achieved it but because now, I had this extra money every month that I knew I didn’t need to spend, so I could save it. And just as I got a rush from seeing my debt balance drop, I now get a rush from seeing my savings balance grow.

I’ve been trying to help out a couple of people who I know are struggling but not been able to really lay it down like this, I will definitely share this post with them. I think it’s brilliantly written and addresses the fact that many people aren’t aware of the total debt out of fear and not wanting to be crushed by it. This empowers people and allows them to face it head on and hopefully with as little fear as possible. Thank you for writing this important post.

Hi Josey, I’m so glad you enjoyed this post.

I love the simplicity of your approach to clearing your debt and no doubt you would be a valuable friend person to lean on for advice.

I can totally relate to the extra money you create once you clear debt-it was an unexpected benefit.

Thanks again for sharing your experience with us.